“Winter is here,” is how Morgan Stanley analysts described January’s stock market rout Monday, alluding to the Game of Thrones motto calling…

For more crisp and insightful business and economic news, subscribe to

The Daily Upside newsletter.

It’s completely free and we guarantee you’ll learn something new every day.

“Winter is here,” is how Morgan Stanley analysts described January’s stock market rout Monday, alluding to the Game of Thrones motto calling on warriors to steel themselves for harsh environments.

At least the day brought a slight reprieve, as the Dow, Nasdaq and S&P 500 eked out small gains after a week of sell-offs. But, just like in Winterfell, investors and regulators have been readying for months for days when frothy market conditions would settle down.

All According to Plan

One major sign investors anticipated a decline in stocks well in advance of this month was the sheer volume of IPOs in 2021 that had early lock-up period releases — meaning shareholders could sell their holdings off quickly while stock valuations were still at record highs. According to Renaissance Capital, 25% of IPOs last year had such provisions, more than double the 9% in 2020.

Meanwhile, stock market bears have been warning for months that markets were positioned to retreat, especially as regulators taper their pandemic stimulus programs and raise interest rates, and investors seem to have quietly agreed. Regulators have been eyeing the moment, too. Since November, the US Federal Reserve began signaling a hawkish pivot that would tighten financial conditions for markets, but telegraphing things in advance has allowed this to play out in an orderly, manageable way:

- Stocks are falling, but in gradual reset — the S&P 500 recovered to a 0.3% gain Monday, after falling almost 4% in the afternoon, continuing a streak of no one-day drops above 2% in 2022.

- After turning in its worst week since March 2020 last week with a 7.6%, the Nasdaq also eked out a small gain — as it’s the most tech-heavy index, Nasdaq volatility is a sign that the frothiest parts of the market (read: tech companies with high, speculative values that trade at high multiples of their earnings) are where sell-offs are concentrated.

Wednesday Surprise: The US Fed will meet tomorrow and one analyst, US Official Monetary and Financial Institutions Forum chair Mark Sobel, suggested the Fed go one step further by giving the markets a “measured jolt” by saying it could raise interest rates or taper asset purchases to stimulate the economy even more quickly than previously announced. A jolt like that, in theory, could help to rein in the Fed’s other concern, inflation, which is fine as long as the price of a burger drops as much as your burger stocks do.

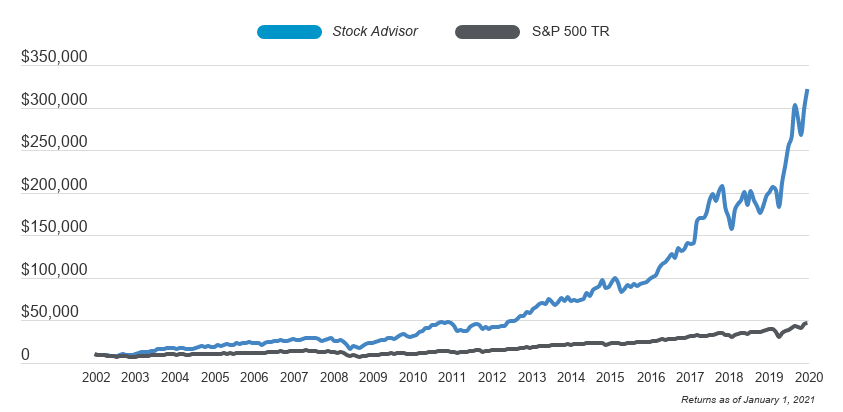

Motley Fool Returns

Stock Advisor

S&P 500

498%

134%

Discounted offers are only available to new members. Stock Advisor will renew at the then current list price. Stock Advisor list price is $199 per year.

Stock Advisor launched in February of 2002. Returns as of 01/25/2022.

Calculated by Time-Weighted Return

`;

timerContainer.appendChild(timer);

initTimer();

};

init();

});

![[Book Review] The Blade Itself (The First Law Trilogy) by Joe Abercrombie](https://bendthekneegot.com/wp-content/uploads/2018/01/1516047103_maxresdefault-218x150.jpg)