This week sees SAP start in earnest on its restructuring program, first flagged up during the FY2018 Q4 earnings call. According to multiple sources, this is the biggest reorg in 20 years. What’s happened, how is it working out and what does it mean for the future?

The background

During the earnings call and subsequent media briefing, CFO Luca Mucic described it as a ‘fitness program,’ an interesting choice of phrase when you’re announcing north of 4,000 positions due for termination. For his part, CEO Bill McDermott stressed that regardless of the program, SAP will end up with more employees by the end of 2019, suggesting a net add of about 5,000 employees to take the total north of 100,000 globally.

At the time, the company was understandably shy of talking specifics. As a global operation, SAP has to traverse the working practices and legislative environments of entire countries and states. Not least among these is the highly regulated German market where you don’t go firing people at will. Compare that with the US where a number of states operate ’employed at will’ practices.

On its face, a reduction of 4,000-ish doesn’t sound like a lot for a workforce of the size SAP deploys but as always, the devil is in the detail. As we are today, a picture is emerging but it is a tad confusing and not entirely clear. One thing is for certain, the perceived optics are terrible.

What happened?

As I understand it both from looking at the figures, going back into history and from multiple sources, SAP has to slim down in some areas and beef up elsewhere. Mucic’s ‘fitness’ metaphor is therefore appropriate.

It seems that SAP has determined that it cannot realistically compete with AWS, Google and Microsoft for cloud platform offerings and is, therefore, scaling those back. That’s one easy way to unload staff and should be of no surprise to anyone in particular. Even though SAP touts a cloud platform, it never figures in any of the surveys of runners and riders. And despite the obvious allure as evidenced by AWS numbers (and Microsoft’s recent rocketing performance) SAP isn’t going to fight battles it can’t win. However, that still leaves the problem of engineering for each of those choices. That’s BIG engineering work that requires a considerable resource for very little obvious payback other than protecting existing application investments.

The other big area for attention is SAP’s on-premises business. I can’t recall exactly which year but I think it was 2012 when I said that if SAP hadn’t figured its cloud story by 2017 then it would have serious trouble. At the time, SAP said it was running out support for certain on-premises offerings in 2020 and I calculated that customers would need at least 3 years to make a cloud shift.

It turns out I was wrong but that was because following user group pressure, SAP extended EOL for ECC through to 2025 but made very clear that customers would need to be on S/4 HANA by 2025. There is plenty of rumor that 2025 will end up as 2030 but in placing its bets, SAP can’t think that way.

Competitors are coming at it quickly. Salesforce just flagged $28 billion in revenue ambition by 2023. For its part, SAP has flagged $39 billion by the same date. And let’s not forget Workday which has flagged a $10 billion run rate within six years. Both Workday and Salesforce are gaining market share and taking customers from SAP, albeit the attrition rate for SAP to Workday is lower than that from Oracle/PeopleSoft. And that’s just across two categories. The competition among advanced technologies is far fiercer with customers prepared to risk spending with any of hundreds of new players.

What is more worrying is that sources tell me that SAP’s cloud retention rate is not as good as they would like. Various numbers are bandied about so I won’t talk specifics as I have not received direct confirmation. But, it explains why, at the recent Capital Markets Day, SAP talked about doing multi-year deals at scale. At the time I thought it sounded like on-premises by another name but this recent insight puts a different perspective on SAP’s comments.

How SAP achieves that in markets where sales enablement, deployment, and the functional fit need attention is a work in progress. It doesn’t take much imagination to understand that Rob Enslin has the mother of all jobs on his hands, with what Holger Mueller calls the ‘six sisters’ of cloud apps, under his management. I’ll come back to that.

What’s happening today?

From what I can gather, SAP started its program in Germany, including at its Walldorf HQ, offering early retirement to some of the ABAP ‘greybeards.’ In addition, employees are being offered the opportunity to apply for one of the 3,000 openings elsewhere. This is where I get my Hunger Games metaphor. 4.5 down with 3 up is a competitive environment.

In the 2015 reorg, SAP targeted older people in Germany for retirement but that program didn’t go as well as SAP expected. Despite assembling attractive voluntary packages, the numbers of people expected to take up the offering didn’t materialize. It’s different this time.

We’re a few years on, people are older, the ABAP writing is on the wall for those on-premises developers, support folk and the like so it makes more sense for them to take a deal. Even so, my understanding is that the scale of RIF is unprecedented, signaling a full change of season is in play.

Elsewhere, the situation is much more dramatic with entire locations being wiped out in some cases. While that may be understandable given SAP’s intent, the impact reverberates. By 3 pm GMT today, my email and back channels on Twitter and elsewhere had lit up like the proverbial Christmas tree. That pace of message continued relentlessly through until 9 pm with messages of inquiry, comment, outrage, and requests for details about some of those affected that others would like to interview for positions outside SAP.

So when others describe this as the biggest reorg in many years, it is hard to disagree.

What did SAP get right and wrong?

Flagging this as it did at the end of January was right. Leaving the detail vague was also right. Counting up how it can make long-term savings of around €1 billion pa, as SAP indicated, was undoubtedly an exercise it undertook with care and as much precision as fast-moving markets allow. Creating attractive leaver packages for those it decided were to go was as humane as you’d expect from SAP. And for all of those things, I give them credit.

But the manner in which some people have been selected along with a few other things that are now in view mean that SAP has landed itself with some real problems.

Again, SAP is working on a location and business unit basis with certain targets in its sights. However, what SAP has failed to do is learn from the past when it lost some sorely needed talent and dumped industry experts. I have talked about this before and as I said on Twitter:

This is EXACTLY what I meant when I feared that SAP runs the risk of RIF’ing the wrong people. For those that don’t know, Thomas is one of a handful of genuine rockstar devs at SAP who is also a fabulous @SAPMentors. How many more? #utterfuckingmadness https://t.co/e8pqCIE4qC

— ⒹⒺⓃ•Ⓗ ㋡ (@dahowlett) March 6, 2019

It turns out that Rich Heilman, Thomas Jung’s longtime HANA partner was also laid off. This is a disaster. Why?

If you understand anything about development it is that it is often a very few geniuses who make software sing. In this case, Jung and Heilman are those geniuses. I know that from personal experience. What’s more important is that Jung and Heilman are the two people who could reliably help sales close out deals by explaining to technical leads what needs to be done in HANA environments. They developed and led masterclasses all over the world. They understand SAP HANA end-to-end. They also commanded deep respect among the SAP developer community.

No one is irreplaceable but when you’ve got a platform and product that needs support, dumping the best people is little short of idiotic because, as I also said on Twitter:

What SAP has failed to grasp is that once you’ve lost great talent you never get it back. The long term cost in terms of lost value is immeasurable.

— ⒹⒺⓃ•Ⓗ ㋡ (@dahowlett) March 6, 2019

I do not say these things lightly or with emotional intent. There’s plenty of that to go around by others and which usually start with…well – I’ll leave you to figure that out.

The people I have named are not the only ones. I received numerous messages telling me about various people who I either know well or tangentially through the SAP network who are in a similar position or being impacted in other ways. In short, there’s a pattern here which I believe will cost SAP dearly in the long term. Why?

SAP operates a set of talent growth programs it uses to identify the leaders of tomorrow across several dimensions. This is a very good way to build bench strength and has been one of the hallmarks of SAP’s history. But those same programs don’t do talent management so well. What’s happened here is that folk who are experts at what they do but have no ambition to become EVPs are not viewed in the same way as those who are happy to join the political fight needed to become a leader. It’s a recipe for losing the best if not the most aggressive in the talent pool.

What else?

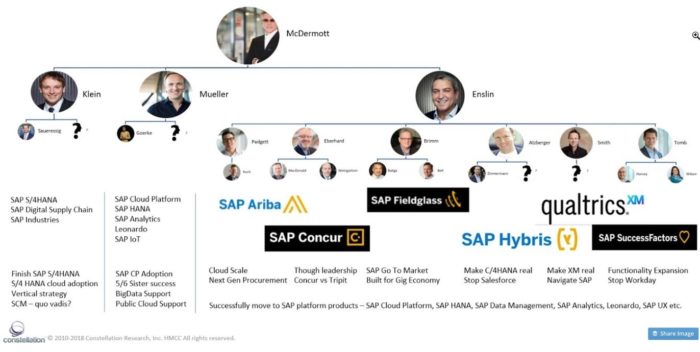

Holger Mueller’s well-drawn analysis of recent changes in the development organization points to important changes in how customers will get what they want (or not) from the re-formed groupings. Mueller’s analysis describes what he calls a ‘matrix organization’ rather than one where development is in the hands of a single leader.

This can be argued a number of ways yet the manner in which SAP has chosen to reorg is understandable in the context of its exploding SKU catalog. But it brings additional questions. Mueller explains the practical reality of managing this matrix:

As usual, when you can live with standard functionality – you are in good shape. But if you need anything new / strategic / co-development wise from SAP – you have to navigate the complexity.

Say for example you want something strategic from SAP Ariba. So you want to get the buy-in from Darren Koch (Chief Product Officer at Ariba). Better get his bosses’ buy in as well, that’s Barry Padgett, who works for Rob Enslin. Assume the new functionality is innovative and needs something from machine learning, and it runs on e.g. Azure. In comes Juergen Mueller with his team. And say it needs to feed back into your SAP Finance system – in come Christian Klein (and Thomas Saueressig, who is in charge of S/4HANA and more). You quickly run out of seats in the minibus or conference call lines. Customers who want to cut the chase and look for Bill McDermott’s commitment, may well try to (and likely get it). But let’s not forget that for McDermott to get this done, he needs to coordinate at least three, if not 7 executives (his three board members, the Ariba executives, and for making it easy – just one additional one from Klein and Mueller. For instance, SAP SuccessFactors has two product leaders – Amy Wilson and James Harvey. That makes it 8 executives. Add to that the usual strategic deals that Adaire Fox-Martin and Jennifer Morgan will throw in, especially in Q4. I can see 50% of board meetings being about product ad product development coordination. How often do you have all these executives in the room (or the video conference) to make real time trade-offs between road maps, headcount and customer demands.

Interesting or what? I see other issues. I’ve said that Enslin has the mother of all jobs. I can see for instance an urgent need to find easy ways to consume SAP content across the entire enterprise if any business is to achieve the intelligent enterprise vision. That’s a data issue.

How do you do that when platforms, analytics and Leonardo are under someone else’s control? What about the ever-present nemesis of integration? Has SAP given up on that lofty idea? What about the variety of platforms on which these clouds can sit? Others think Enslin’s challenges are further down the food chain with functional gap-filling a higher priority.

Then there’s the S/4 HANA question. In view of the developer reductions, does this mean that this solution is defocused on the premise (sic) that somehow or other it will all be all right on the night?

What about resource allocation? We’ve just seen the playing out of the Hunger Games at the grassroots level, this element is more like Game of Thrones.

My understanding is that so far, the chief players have been cooperating in the interests of the whole but how long that continues is an open question. Leaders too have to manage the impact of staff changes so you can expect that eyes will not be on the prize in the next few weeks or perhaps months. That’s a challenge when those same leaders have full LOB responsibility and not just development.

And what about SAP’s much-vaunted Community? The SAP Mentor community, in particular, seems to be slowly withering and this latest restructuring punctures that group even more. The Community has served as a trove of vital information for those who work on SAP technology. Will that slowly evaporate?

The message to customers

As always. in these things, my primary concern has to be for what customers can expect. Mueller is hopeful that a more efficient organization (SAP has slashed lines of business and now expects managers to do a lot more) will mean better outcomes for customers. But as we know, the SAP universe is a melange of companies in all sorts of states of readiness. Vinnie Mirchandani fears that as much as 60% of the installed base is nowhere near ready.

But then I am thinking about the ongoing drumbeat of innovation at the core that is required by the user groups and which now looks to be at risk – at least for the on-premises solutions. What happens here? Do those same customers finally bite the S/4 bullet or do they seek true love elsewhere?

Final words

I said at the top of this post that the optics on this are terrible but let’s be clear, almost everyone who messaged me understands SAP’s need to get fitter not fatter.

Some of my reasons are rooted in a very practical view of outcomes and difficulties SAP may face. But then this is also the week that SAP huddles a bunch of analysts, including our own Jon Reed into a conference room in Utah to talk cloud. I don’t have any insight into what’s being said but if you’re one of the dev leadership – do you really want to be dealing with today’s fallout?

SAP is insistent that this is not a layoff and points to the opportunities elsewhere and on a global scale. But if your aim is to be cost fit then how attractive will those opportunities turn out to be? And exactly what do you say to those who are very clear that they are being laid off. There is no logical argument here.

SAP says it wants to talk to me further on these topics and I welcome that. But today is not that day. Questions continue to surface but the sentiment remains the same: this may have been necessary (and obviously painful) but some of the actions defy understanding.

Endnote: Mueller’s diag is already out of date. Bjoern Goerke is gone too.

Image credit – via Holger Mueller, via SAP.

Disclosure – SAP, Salesforce, Workday, and Oracle are premier partners at the time of writing.

![[Book Review] The Blade Itself (The First Law Trilogy) by Joe Abercrombie](https://bendthekneegot.com/wp-content/uploads/2018/01/1516047103_maxresdefault-218x150.jpg)